With the sharp rise of international crude oil prices and the continued impact of high oil prices, polyolefin industry is currently facing huge losses. Although polypropylene has many production modes, it cannot escape the profit squeeze of different production modes brought by high oil prices.

1

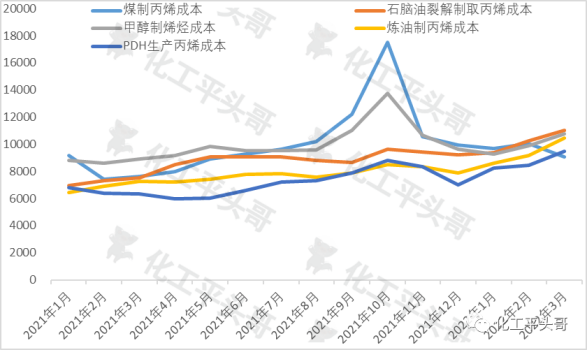

Under different production processes, the production cost of propylene in China is greatly different, and the cost of coal-to-olefin has been relatively high in most of the past year, which is directly related to the sharp rise in coal price caused by the dual control of energy consumption. The cost of PDH olefins production is always in the position of cost and is in a relatively competitive propylene production mode.

2

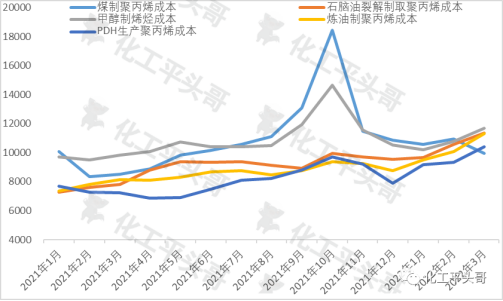

Due to the fact that methanol price has not fluctuated abnormally in the past year and its correlation with coal and crude oil has decreased, the competitiveness of methanol to olefin and polypropylene has been greatly enhanced. In the past year, cost competitiveness is stronger than coal.

3

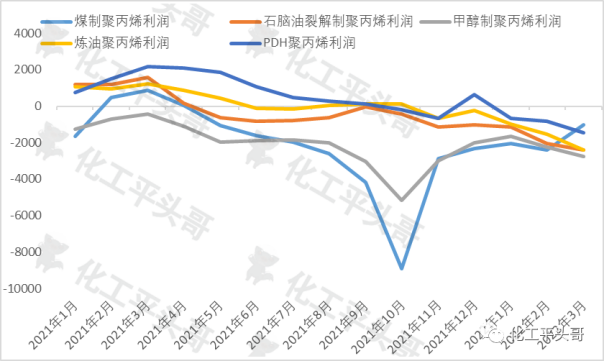

The double control of energy consumption in October 2021 led to a sharp rise in coal prices, which also created huge cost increases and losses for China's coal-based propylene and polypropylene. According to statistics, in the past year, China's coal to polypropylene production profit appeared nearly 9000 yuan/ton loss, also the largest in history.

4

At present, no matter which production method, polypropylene has always been in the situation of loss, in which the loss of PDH polypropylene is the lowest, while the loss of methanol polypropylene is the largest. This is due to the sharp rise in the price of crude oil and the spread of the negative effects of the rise in crude oil. On the other hand, it also highlights the current situation of supply-demand contradiction in China's polypropylene market, resulting in huge losses of polypropylene, which cannot be effectively transmitted to the downstream.

According to statistical data calculation, in the past year, the cost of propylene produced by different production methods in China is the highest, that is, the weakest, while the cost of propylene produced by PDH and oil refining is the lowest, and the cost of propylene produced by PDH has the most competitive advantage.

However, by the end of March 2022, due to the decline of coal price, the cost of coal to propylene decreased significantly and was still in a downward trend. This may lead to a reversal of competitiveness in the coming April, and the competitiveness of coal-based propylene may be reversed.

Figure 1 Propylene cost comparison of different production processes (unit: Yuan/ton)

According to the cost of polypropylene produced by different processes, it is found that in the past year, the cost of polypropylene made from coal is the highest and its competitiveness is the weakest, while that made from PDH is the lowest and its competitiveness is the strongest. This is consistent with the competitiveness of coal to olefin.

It should be noted that the polypropylene cost of different production processes in China largely reflects the olefin cost of different processes. Due to cost differences between different processes, the cost of polypropylene from refining and naphtha cracking is not considered as offset by unit by-products. According to the industry formula, the cost of naphtha cracking polypropylene has a certain competitive advantage.

Figure 2 Cost comparison of polypropylene in different production processes (unit: Yuan/ton)

According to the average price of polypropylene market, does not take into account the market price of difference under different process, contrast, found that in the past year, China's polypropylene production profits, it may be said "a glimpse, coal profits at the height of polypropylene production losses of close to 9000 yuan/ton, and the past year, most of the time in the circumstances of the loss.

PDH polypropylene will start to lose money in mid-to-late 2021, propylene polypropylene from refining by product will start to lose money in June 2021, polypropylene from naphtha cracking will start to lose money in mid-2021, polypropylene from coal will start to lose money in early 2021, and polypropylene from methanol will start to lose money in early 2021.

It should be specially noted that due to the slight differences in production mode, industrial chain matching and cost among enterprises, the cost difference among polypropylene enterprises is obvious. Therefore, the calculated cost is the average cost of the industry, not the cost of enterprises.

FIG. 3 Comparison of sales profit of polypropylene with different production processes (unit: Yuan/ton)

Excerpt from China Chemical Industry Information Weekly